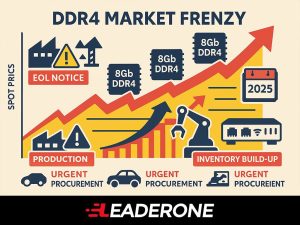

Infographic showing DDR4 market frenzy with surging prices, reduced supply, and demand spike from industrial sectors.

The DDR4 market frenzy is intensifying. Spot prices for DDR4 memory are surging, with reports indicating significant increases in recent weeks. This unexpected price hike for the previous-generation DRAM technology comes as major memory manufacturers shift focus and capacity towards next-gen solutions like DDR5 and High-Bandwidth Memory (HBM) for AI applications. The rapid escalation is creating ripples across various industries that still heavily rely on DDR4.

Why DDR4 Prices Are Skyrocketing

Several key factors contribute to the current DDR4 market frenzy and price surge:

- Production Cutbacks and End-of-Life (EOL) Plans: Leading DRAM manufacturers, including Samsung, SK Hynix, and Micron, are strategically reducing or even halting DDR4 production. They are phasing out DDR4 products. Micron has issued EOL notices. Samsung plans to end DDR4 module support by late 2025. SK Hynix has significantly cut its DDR4 production ratio. This aims to free up capacity.

- Shift to Higher-Value Products (DDR5, HBM): The booming AI industry fuels massive demand for high-bandwidth memory (HBM) and advanced DDR5. Memory makers prioritize these more profitable products. This re-allocation of manufacturing capacity directly impacts DDR4 supply.

- Accelerated Procurement and Inventory Building: Despite the shift, many industries still depend on DDR4. This includes automotive, industrial, networking, and even some PC segments. Faced with dwindling supply and rising prices, original equipment manufacturers (OEMs) and industrial PC brands are rushing to build inventory. This accelerates procurement ahead of further price hikes. Some buyers are even stockpiling.

- Geopolitical Factors and Tariffs: Reports suggest that buyers are accelerating procurement ahead of potential U.S. tariff changes. This adds another layer of urgency to demand.

- Speculative Buying: As prices climb, some speculative buyers enter the market. This can further inflate prices in the short term. However, excessive hikes may cause them to pull back.

The Impact of the DDR4 Market Frenzy

The DDR4 market frenzy has significant implications across the tech ecosystem:

- Soaring Spot Prices: Spot prices for standard 8Gb DDR4 chips have seen dramatic increases. Some reports indicate jumps of 50% or even 100% in a short period. This brings prices higher than pre-2022 downturn levels.

- Price Parity with DDR5: In some instances, DDR4 prices have reached parity with, or even exceeded, newer DDR5 chips. This is a rare market phenomenon.

- Challenges for Industries: Companies relying on DDR4 for their current products face higher costs. This impacts profit margins. It can also delay production for specific devices.

- Supply Chain Disruption: The tight supply creates significant disruptions. DRAM makers struggle to set new prices. Some have even suspended quotations due to the demand-supply imbalance.

- Beneficiaries: Taiwanese DRAM makers like Nanya Technology and Winbond Electronics are seeing their shares rise. They benefit from higher prices and increased shipments.

Outlook for the DDR4 Market

Industry experts generally expect the upward trend in DDR4 prices to continue. Major suppliers confirm ongoing “severe shortages.” They plan to primarily supply long-term customers in specific sectors. These include automotive, industrial, and networking. While speculative buying might moderate at some point, the fundamental shift in production priorities towards AI-driven memory will keep DDR4 supply tight.

As the memory market evolves, the DDR4 market frenzy highlights the dynamic interplay of supply chain adjustments, technological advancements, and shifting industry demands. Companies heavily reliant on DDR4 are urged to secure their supply chains and consider their long-term memory strategies.